Elite Value Checking

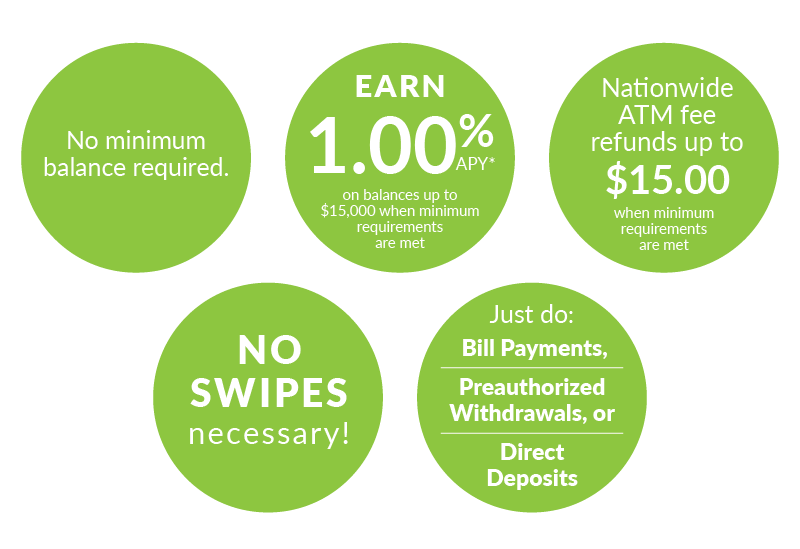

Earn monthly interest—no swiping required. Elite Value Checking rewards you with cash interest when you make bill payments, preauthorized withdrawals, or direct deposits. Enjoy no minimum balance, free online and mobile banking, and up to $15 in nationwide ATM fee refunds per statement cycle when requirements are met.

Elite Value Checking Disclosures

* APY (Annual Percentage Yield)

• Minimum Requirements: Must be enrolled and log into online banking, enroll and receive eStatement notices, and have at least 10 transactions of any combination of bill payments, preauthorized withdrawals, or direct deposits post and settle per statement cycle.

• If minimum requirements are met, balances between $.01 and $15,000.00 will earn the top-tier rate, balances over $15,000.00 will earn the second-tier rate. If you do not meet the minimum requirements per statement cycle, your account will earn 0.01% annual percentage yield.

• Nationwide ATM fee refunds up to $15.00 per statement cycle when minimum requirements are met.

• No minimum balance required.

• Interest compounds daily and is credited on your statement cycle date.

• Interest rate and annual percentage yield may change at our discretion.

• We use the daily balance method to calculate the interest. This method applies a daily periodic rate to the principal in the account each day.

• Interest begins to accrue on the business day you deposit and will be paid to the date of withdrawal.

• The Annual Percentage Yield assumes interest will remain on deposit. A withdrawal will reduce earnings.

• Personal use only.

• There is a $3.00/month service charge for mailed paper statements on checking accounts. Charge waived for account holders 60 years old or older.

Elite Value Checking Statement Cycle Dates

Below are the 2026 statement cycle dates for your Elite Value account For your debit card transactions to qualify they must post and settle on or between these dates. Please remember, merchants have the ability to set a transaction to post and settle at a later date than the day you make the transaction. Please take this into account when making your debit card transactions. If the last day of the month falls on a weekend or a legal holiday your statement cuts on the business day prior to the weekend or holiday.

January 1, 2026 – January 30, 2026

January 31, 2026 – February 27, 2026

February 28, 2026 – March 31, 2026

April 1, 2026 – April 30, 2026

May 1, 2026 – May 29, 2026

May 30, 2026 – June 30, 2026

July 1, 2026 – July 31, 2026

August 1, 2026 – August 31, 2026

September 1, 2026 – September 30, 2026

October 1, 2026 – October 30, 2026

October 31, 2026 – November 30, 2026

December 1, 2026 – December 31, 2026